2018 Green Industry Benchmark Report results and analysis

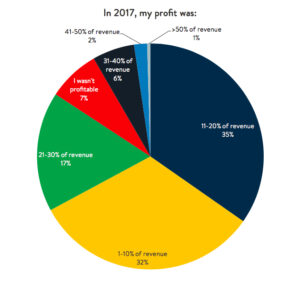

2017 was another banner year for the vast majority of green industry businesses, and they expect more of the same in 2018. But although economic optimism abounds, the lack of quality labor is starting to eat away at profitability and growth. HindSite Software’s annual Green Industry Benchmark Reportalso found businesses are struggling to find employees. A remarkable 88% said they found it somewhat or extremely difficult to find good applicants for their business, up slightly from a year ago.

As a result, 80% of respondents expect to raise prices next year, with 43% citing rising employee costs as the primary driver of their increased process. In order to attract and retain their employees, wages are going up, with 43% expecting to increase wages by at least 3% next year.

The Green Industry Benchmark Reportdetails the results of a two-month-long surveying effort that reflects the opinions of nearly 300 green industry business owners and managers who provide services including landscaping, irrigation service, mowing, fertilizing and snow removal. This is the sixth year HindSite Software has released a Green Industry Benchmark Report.

“The Green Industry Benchmark Reportis the only report of its kind,“ said Chad Reinholz, HindSite’s marketing manager. “With nearly 70 pages of results and analysis and more than 50 graphs, the Green Industry Benchmark Reporthelps green industry businesses better understand how their peers operate – and take steps to improve their businesses.”

Among the key findings:

- Economic optimism abounds in the green industry, with 70% of respondents expecting the economy to improve in 2018, up from 48% just two years ago.

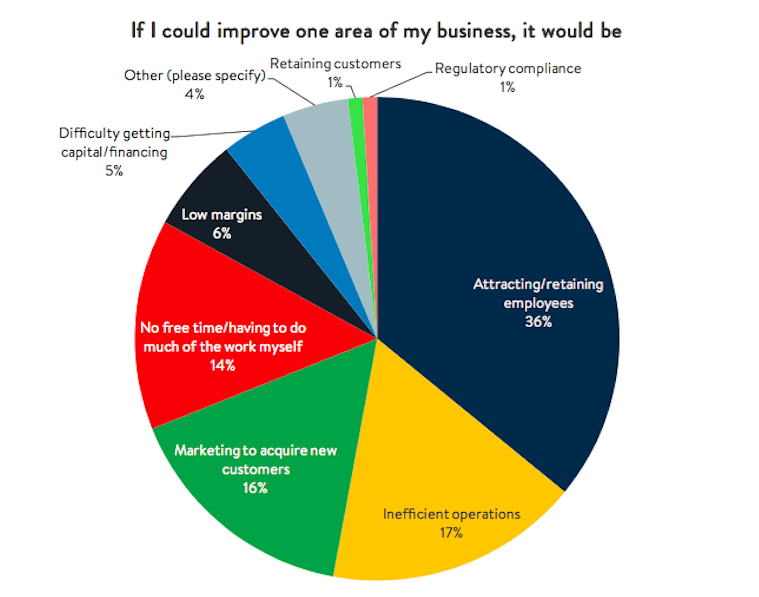

- A tight labor market is the biggest concern for a typical green industry business. 88% of respondents find it somewhat or very difficult to find employees, while just 1% said it was very easy. Additionally, attracting and retaining employees was the number one issue for the typical green industry business, with 36% saying it was their biggest issue.

- As a result of the tight labor market, prices and wages will likely increase in 2018. 43% of respondents expect to raise wages by more than 3%, while 80% expect to increase prices. 43% cited rising labor costs as their primary reason for raising prices.

- To combat a tight labor market, businesses are turning to field service software to be more efficient. Half of respondents now use software, up 7% from a year ago. 43% of field service software users said that the primary benefit is efficiency.

-

Click image to enlarge. All graphics provided by HindSite Software Another way businesses are combatting a tight labor market is by improving employee benefits. Last year, 40% of respondents said they offer health benefits. This year, 45% do.

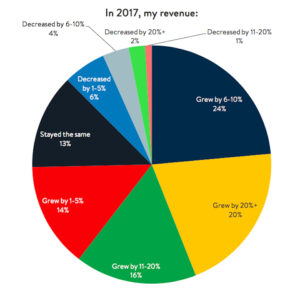

- Businesses expect healthy revenue growth in 2018, with 87% expecting their revenue to increase this year. 74% of businesses experienced year-over-year revenue growth in 2017.

- Weekly training is an indicator of success, with those that train their employees weekly more likely to experience revenue growth in excess of 10%.

This year’s Benchmark Report added information about wages for typical green industry business laborers, including irrigation technicians, crew leaders and crew members.

“We’re always looking to improve the value of the Benchmark Report,” said Reinholz. “Last year we added interviews with green industry business owners and employees. This year, we added data about wages, which we can then cross-reference with the location of the respondent to deliver regional wage averages.”

The Green Industry Benchmark Reportis available to download free at http://info.hindsitesoftware.com/2018-green-industry-benchmark-report.

Landscape Businesswill also be sharing more in-depth analysis from the report during the coming months.